Introduction: Starting Your Investment Journey with Confidence

Investing is one of the most powerful ways to grow your wealth over time. But with so many options available and an ever-changing financial landscape, how do you know where to start? The world of investing can be intimidating for InvestmentTotal.com beginners, with complicated terminology, confusing charts, and an overwhelming number of investment vehicles. That’s where InvestmentTotal.com comes in. This platform is designed to simplify the investing process for individuals of all experience levels. Whether you are looking to build a portfolio from scratch or refine an existing one, InvestmentTotal.com is an invaluable resource that provides the tools, insights, and expert advice needed to make informed decisions. In InvestmentTotal.com this comprehensive guide, we will walk you through the essentials of investing, how to leverage InvestmentTotal.com to your advantage, and why this platform should be InvestmentTotal.com your go-to partner on your financial journey.

Investing wisely isn’t just about picking the right stocks or bonds—it’s about having a strategy InvestmentTotal.com that aligns with your financial goals and risk tolerance. With InvestmentTotal.com, you gain access to all the resources required to develop this strategy. By understanding the fundamentals of investing and using the platform’s user-friendly tools, you can navigate the investment landscape with confidence. In this guide, we’ll break down how you can start investing and how InvestmentTotal.com can provide you with the knowledge, tools, and strategies you need to succeed in the world of finance.

Understanding Investment Basics: The Foundation of Smart Financial Decisions

To effectively start your investing journey, it’s crucial to understand the core principles behind it. Investing is the act of committing money to an asset, such as stocks, bonds, or real estate, with the expectation that it will generate income or grow in value over time. Essentially, investing involves putting your money to work, allowing it to earn returns through interest, dividends, capital appreciation, or other means.

The goal of investing is to grow your wealth, often over a long period. However, it’s important to remember that investing always carries some level of risk. Unlike saving, where the goal is to preserve your capital, investing involves exposing your money to risk in hopes of achieving a greater return. The key is to balance risk with reward, ensuring that your investment strategy is aligned with your financial goals and comfort level.

On InvestmentTotal.com, you’ll find comprehensive resources that help break down these complex concepts into simple terms. The platform provides in-depth explanations about the different types of investments—stocks, bonds, mutual funds, real estate, and more—making it easy for beginners to grasp what each entails. This knowledge will set a strong foundation for you to make informed investment decisions.

How InvestmentTotal.com Helps You Start Investing: Tools, Resources, and Expert Insights

One of the primary benefits of InvestmentTotal.com is that it not only offers educational content but also provides practical tools and resources to help you get started. For someone new to investing, it can be difficult to know where to begin. InvestmentTotal.com streamlines the process, offering a step-by-step approach to navigating the world of investing, including essential tools like portfolio trackers, stock screeners, and risk assessment calculators.

Comprehensive Educational Resources

To ensure that you can invest with confidence, InvestmentTotal.com provides a wealth of educational content. Whether you’re just starting out or already have some investing experience, the platform offers detailed tutorials and articles on a variety of investment topics. The educational section is divided into easy-to-understand modules, covering:

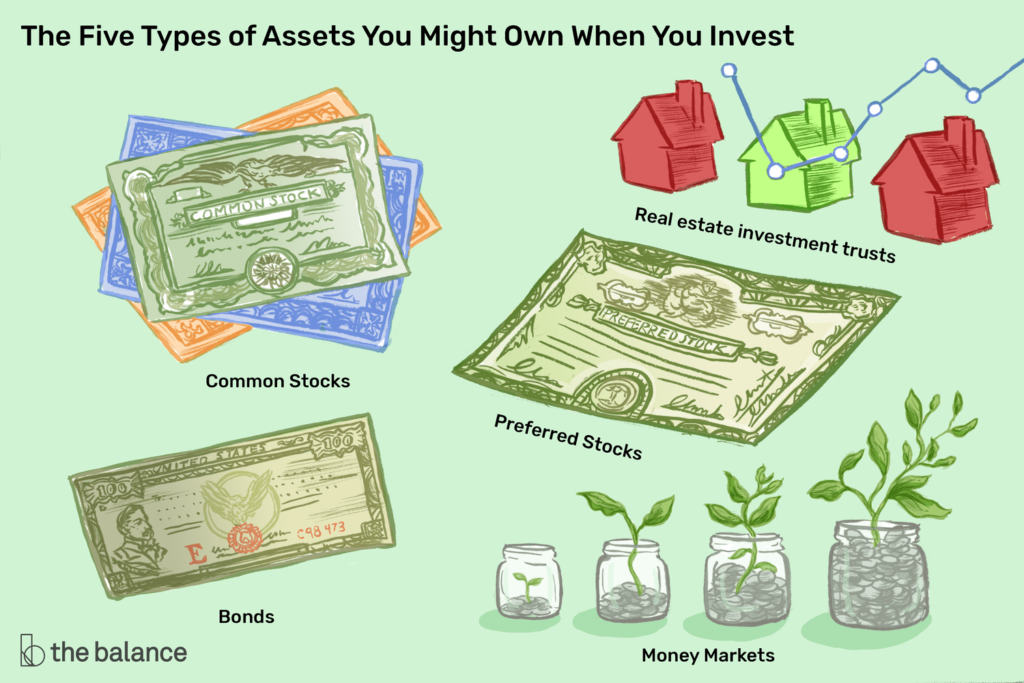

- Investment Types: An introduction to the most common investment vehicles, including stocks, bonds, and real estate, and their respective advantages and risks.

- Investment Strategies: Practical guidance on portfolio diversification, understanding market cycles, and building a strategy based on your financial goals and risk tolerance.

- Investment Basics: In-depth articles about how the stock market works, how to value investments, and how to read financial statements, among other essential topics.

With this wealth of information at your fingertips, InvestmentTotal.com ensures that you can start investing without feeling overwhelmed. This content will help demystify the often-complex world of finance and make you feel more confident about your investment choices.

Investment Tools to Make Smart Decisions

InvestmentTotal.com doesn’t stop at education—it provides a suite of tools designed to make your investment journey smoother and more efficient. Here are some of the key tools you can utilize on the platform:

- Stock Screeners: Stock screeners are powerful tools that help you filter stocks based on specific criteria. Whether you’re interested in high-growth stocks, dividend-paying stocks, or those with a low price-to-earnings (P/E) ratio, the screener helps you narrow down your options. These tools allow you to make more data-driven decisions, which is especially helpful for novice investors.

- Portfolio Trackers: Managing a portfolio requires constant monitoring. With InvestmentTotal.com’s portfolio tracker, you can easily keep tabs on your investments, check the performance of each asset, and assess whether your portfolio is aligned with your long-term goals. This tool helps you stay organized and ensures you’re making adjustments as needed.

- Risk Assessment Tools: Every investment comes with its own set of risks. InvestmentTotal.com helps you understand the risks associated with different assets through in-depth analysis and risk assessment tools. You can calculate the potential downside of an investment and determine whether it fits within your risk tolerance.

These tools, combined with the platform’s educational resources, will help you make informed, calculated decisions.

Different Types of Investments on InvestmentTotal.com: Understanding Your Options

Now that we’ve covered how InvestmentTotal.com can help you get started, let’s take a closer look at the different types of investments available on the platform. Each type of investment comes with its own set of opportunities and risks, so understanding them is crucial before making any decisions.

1. Stocks

Stocks represent ownership in a company. When you buy shares of a stock, you’re essentially purchasing a small portion of that company. Over time, as the company grows and becomes more profitable, the value of its stock increases. In addition to capital appreciation, some stocks pay dividends, which provide a stream of income to shareholders.

Stocks can be volatile, and their prices fluctuate based on factors like company performance, industry trends, and macroeconomic conditions. While they offer the potential for significant returns, they also carry the risk of loss. InvestmentTotal.com offers expert insights on various stocks, helping you assess their potential and decide which ones best fit your portfolio.

2. Bonds

Bonds are fixed-income securities issued by corporations or governments. When you invest in bonds, you lend money to the issuer, who agrees to pay you interest at regular intervals until the bond matures. At maturity, the issuer repays the principal amount of the bond.

Bonds are generally considered less risky than stocks because they offer a predictable return. However, they tend to offer lower returns compared to equities. InvestmentTotal.com helps investors understand the various types of bonds, including government, corporate, and municipal bonds, and assists in choosing the right bonds based on your risk appetite and investment goals.

3. Real Estate

Real estate is another popular investment vehicle, involving the purchase of property with the expectation that its value will increase over time. Real estate can provide steady income through rental properties or substantial capital appreciation if the property value rises.

Investing in real estate can be more hands-on than stocks or bonds, requiring property management or dealing with tenants. InvestmentTotal.com provides in-depth guides on how to evaluate real estate opportunities, analyze market trends, and make strategic property investments.

4. Cryptocurrency

Cryptocurrency is a newer and highly volatile investment option. Digital currencies like Bitcoin, Ethereum, and others have gained popularity due to their high potential for growth. However, they are also risky, as their prices can fluctuate dramatically based on market sentiment and regulatory developments.

InvestmentTotal.com helps you understand the world of cryptocurrency by providing resources on how to buy, store, and trade digital assets. The platform also provides expert analysis on emerging trends in the cryptocurrency market, helping you stay informed about this evolving investment class.

How to Build a Diversified Portfolio Using InvestmentTotal.com: Reducing Risk and Maximizing Returns

Diversification is one of the most effective strategies for reducing risk and increasing the potential for steady returns. The idea behind diversification is simple: by spreading your investments across a range of asset classes—stocks, bonds, real estate, and even cryptocurrency—you can reduce the impact of any single investment’s performance on your overall portfolio.

On InvestmentTotal.com, you can learn how to diversify your investments based on your personal risk tolerance, investment goals, and financial timeline. The platform provides resources to help you assess the level of risk in different asset classes, calculate your expected returns, and build a portfolio that balances stability and growth.

Why Trust InvestmentTotal.com? Key Features That Set It Apart

Given the many investment platforms available, why should you choose InvestmentTotal.com? Here are a few reasons why this platform stands out:

- User-Friendly Interface: The platform is designed with beginners in mind. Whether you’re a first-time investor or a seasoned pro, you’ll find the interface intuitive and easy to navigate.

- Comprehensive Educational Content: InvestmentTotal.com offers extensive resources to help you understand every aspect of investing, from the basics to advanced strategies.

- Expert Analysis: The site features insights and recommendations from investment professionals who understand the market and can help guide your investment decisions.

- Robust Tools: From stock screeners to portfolio trackers, InvestmentTotal.com provides essential tools to help you monitor your investments and make data-driven decisions.

Conclusion: Take the First Step Towards Financial Freedom with InvestmentTotal.com

In conclusion, investing is an essential part of achieving long-term financial success. With the right resources, tools, and strategies, you can grow your wealth, reduce financial risks, and secure a brighter future. InvestmentTotal.com offers a comprehensive, easy-to-use platform that empowers investors of all levels to take control of their financial destiny. Whether you are just beginning your investing journey or looking to refine your strategy, InvestmentTotal.com provides everything you need to make informed decisions and grow your wealth.

Start your investment journey today and trust InvestmentTotal.com to be your partner in success!